alt="Financial plans like tomato" width="1536" height="1024" />A strong financial plan is more essential than ever in today’s world of nonstop headlines, rising interest rates, and global instability. From market downturns to economic uncertainty, the noise can be overwhelming—especially for those working to protect and grow their family’s wealth. But here’s the truth: reacting out of fear rarely leads to good outcomes.

alt="Financial plans like tomato" width="1536" height="1024" />A strong financial plan is more essential than ever in today’s world of nonstop headlines, rising interest rates, and global instability. From market downturns to economic uncertainty, the noise can be overwhelming—especially for those working to protect and grow their family’s wealth. But here’s the truth: reacting out of fear rarely leads to good outcomes.

But here’s the truth: reacting out of fear rarely leads to good outcomes.

One of the greatest gifts we can give ourselves, especially in turbulent times, is the ability to pause, breathe, and return to a long-term perspective. As advisors, part of our role is not just to manage portfolios, but to offer guidance that helps clients navigate emotional decision-making with clarity and calm.

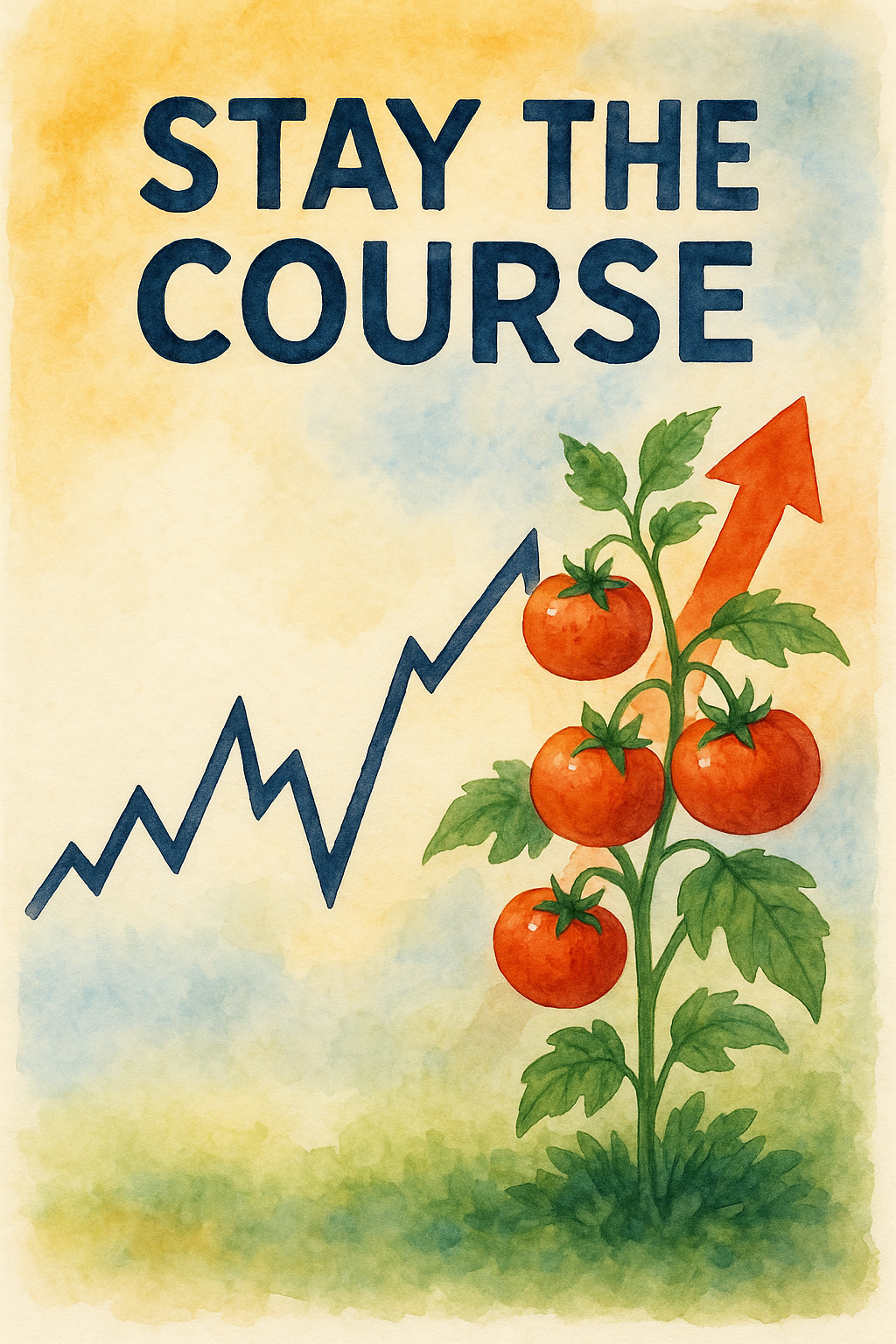

A Lesson from the Garden

Not long ago, my youngest daughter asked why we weren’t pulling up our tomato plants when the first fall frost arrived. The leaves had wilted and turned dull, and to her, the garden looked finished.

“Because,” I told her, “what we see today doesn’t always reflect what’s still possible. A sunny spell might still ripen what’s left on the vine.”

That moment stuck with me. In many ways, it mirrors how we should think about a financial plan. When the market dips or news turns grim, it’s easy to feel like it’s time to make drastic changes. But just like in the garden, a rough patch doesn’t mean it’s over—it means we wait, reassess, and trust the work we’ve already put in.

A strong financial plan is built to weather seasons of uncertainty. Investors who stay the course, even during downturns, are often better positioned when recovery begins. The key is not to let fear uproot progress. Instead, remain steady, lean on your plan, and remember: growth often comes after a little patience and care.

How to Mitigate Stress When Headlines Turn Grim

If you find yourself anxious or overwhelmed by what you’re hearing in the news, here are a few ways to steady the ship:

-

-

Revisit Your Financial Plan

– Your plan was designed for more than just good times. It includes buffers, flexibility, and strategy for moments just like this.

-

-

- Focus on What You Can Control – You may not be able to control interest rates or the global economy, but you can revisit your budget, maintain healthy savings, and stay invested in a diversified way.

-

- Limit News Exposure – Doomscrolling rarely helps. Instead, choose one or two reliable sources and check in only occasionally.

-

- Talk to Your Advisor – Sometimes, just walking through your concerns with someone who understands your full financial picture can be incredibly grounding.

- Lean into Gratitude and Perspective – Remember, markets go up and down, but many of life’s most meaningful returns aren’t measured in dollars. Think of your family dinners, kids’ soccer games, early morning hikes, or that first cup of coffee in peace. Those are returns, too.

Why Positivity Is a Financial Asset

alt="Financial plans like tomato" width="1024" height="1536" />

alt="Financial plans like tomato" width="1024" height="1536" />

Staying optimistic isn’t just about “feeling good. It’s discipline. It’s a strategy. When you approach the future with measured confidence, you’re more likely to make decisions based on logic, not panic. You’re more open to opportunities others may miss. And most importantly, you’re modeling financial resilience for the next generation.

At 49th Parallel Wealth Management, we’ve walked clients through times of plenty and periods of uncertainty and if there’s one thing we’ve learned, it’s that staying the course with a solid, personalized plan always beats making decisions based on fear.

So next time the news feels heavy, or the markets take a dip, remember this: Even when the vines look withered, sometimes the sweetest fruit is just around the corner.

Let’s keep your plan growing.