alt="RRSP" width="1024" height="1024" />

alt="RRSP" width="1024" height="1024" />If you moved from Canada to the U.S. for work, lifestyle, or retirement, but plan to return to Canada in the near future, you’re in a unique tax window that could offer an important opportunity: making RRSP withdrawals before you re-establish Canadian tax residency.

Here’s why it might make sense.

1. U.S. Taxation on RRSP Withdrawals Is Often Lower Than Canadian Taxation

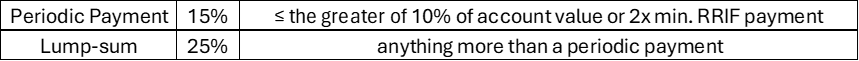

While living in the U.S. as a non-resident of Canada, lump-sum withdrawals from your RRSP are subject to a flat 25% withholding tax. The withholding on periodic payments is reduced to 15%.

A periodic payment is up to the greater of 2x the minimum RRIF payment for your age or 10% of the closing account balance from the prior year. Any amount greater than that is considered a lump-sum and has a 25% withholding. That tax is withheld at source and may be your only Canadian tax obligation, no Canadian return required.

alt="" />

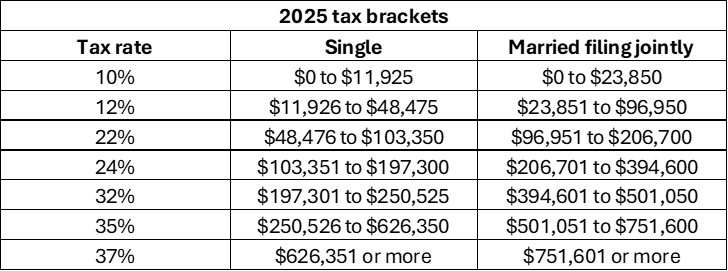

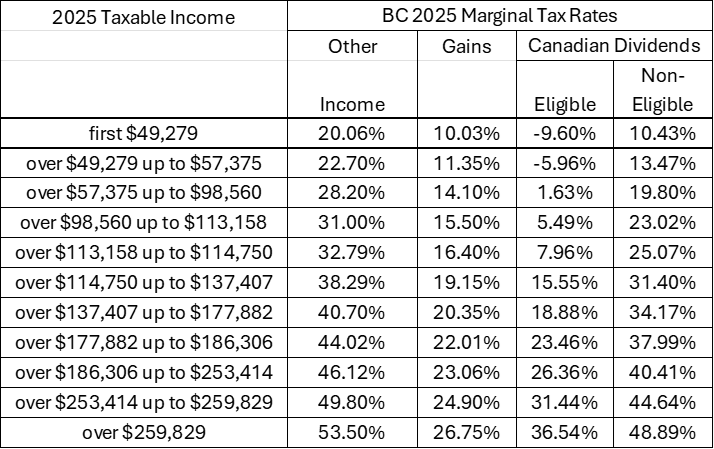

alt="" />From a U.S. perspective, when you receive an RRSP or RRIF distribution, only the unrealized gains are taxable as foreign income on your U.S. 1040 tax return — learn more about the U.S. tax treatment of RRSP withdrawals. Contributions, interest, dividends, and realized capital gains can be distributed tax-free as a return of capital even though you deducted the income when you made your RRSP contribution in Canada.

alt="" />

alt="" />To reduce the proportion of your RRSP that is taxable in the U.S., sell everything in the account before you move and enter the U.S. carrying only cash. Since only the unrealized gains in your RRSP are taxable from a U.S. perspective, entering the country with only cash means that only the growth from that time forward will be taxable in the U.S. Done right, very little of your RRSP distributions will be subject to taxation in the U.S. for the first few years.

Compare that to what happens if you wait until you’re back in Canada: RRSP withdrawals are fully taxable as income, taxed at your marginal rate, which can be 50%, or more depending on your income and province.

alt="" />

alt="" />2. No U.S. Early Withdrawal Penalty

Unlike IRAs or 401(k)s, RRSPs are not subject to the 10% early withdrawal penalty under U.S. tax law. So if you’re under 59½, you won’t face an extra penalty for accessing those funds while living in the U.S.

However, withdrawals are still reportable as income on your U.S. return, and the Canadian tax withheld can be used as a foreign tax credit to avoid double taxation.

3. You Can Choose the Timing and Amount

You don’t have to collapse the whole RRSP. Strategic partial withdrawals in the early years after your move or during a market dip (so you withdraw fewer gains from a U.S. perspective) can help manage the tax impact on both sides of the border.

4. Once You’re a Resident of Canada Again, There’s No Going Back

Once you move back to Canada and become a resident again for tax purposes, this strategy disappears. All RRSP withdrawals will be added to your Canadian taxable income, and you’ll lose the simplicity of the flat-rate tax.

Key Considerations Before You Withdraw

- Are you sure you won’t return to the U.S. for work or retirement?

- How long will it be until you start taking RRSP/RRIF distributions? Anytime you pay tax early you are creating tax drag on the portfolio. You should make sure that the difference in the interest rate paid justifies the tax drag on the portfolio.

- What portion of the RRSP is taxable in the U.S.?

- How much other taxable income do you have in the U.S.?

- Are you doing other tax planning while you are in the U.S. such as Roth conversions or realizing gains on stock options before you move back to Canada?

Speak With a Cross-Border Advisor First

Every situation is unique. At 49th Parallel Wealth Management, we specialize in helping Canadians and Americans navigate this complex transition with cross-border financial planning strategies.

We’ll help you:

- Understand the tax implications in both countries

- Plan withdrawals and saving patterns to minimize overall taxation

- Evaluate currency conversion timing

- Prepare for re-entry to Canada’s tax system

- Coordinate your RRSP with U.S. accounts like IRAs, 401(k)s, and Roth IRAs

If you are crossing the 49th parallel again, plan wisely.

You may only get one shot at this opportunity. Let’s make sure you take full advantage of it.

📞 Book a free consultation today. From the Desert to the Tundra™, we’ve got your back.